Financials

Half-Yearly Financial Statement And Dividend Announcement 2025

Financials Archive![]() 注: 文件是Adobe(PDF)格式。

注: 文件是Adobe(PDF)格式。

请下载免费的 Adobe Acrobat Reader 来查看这些文件。

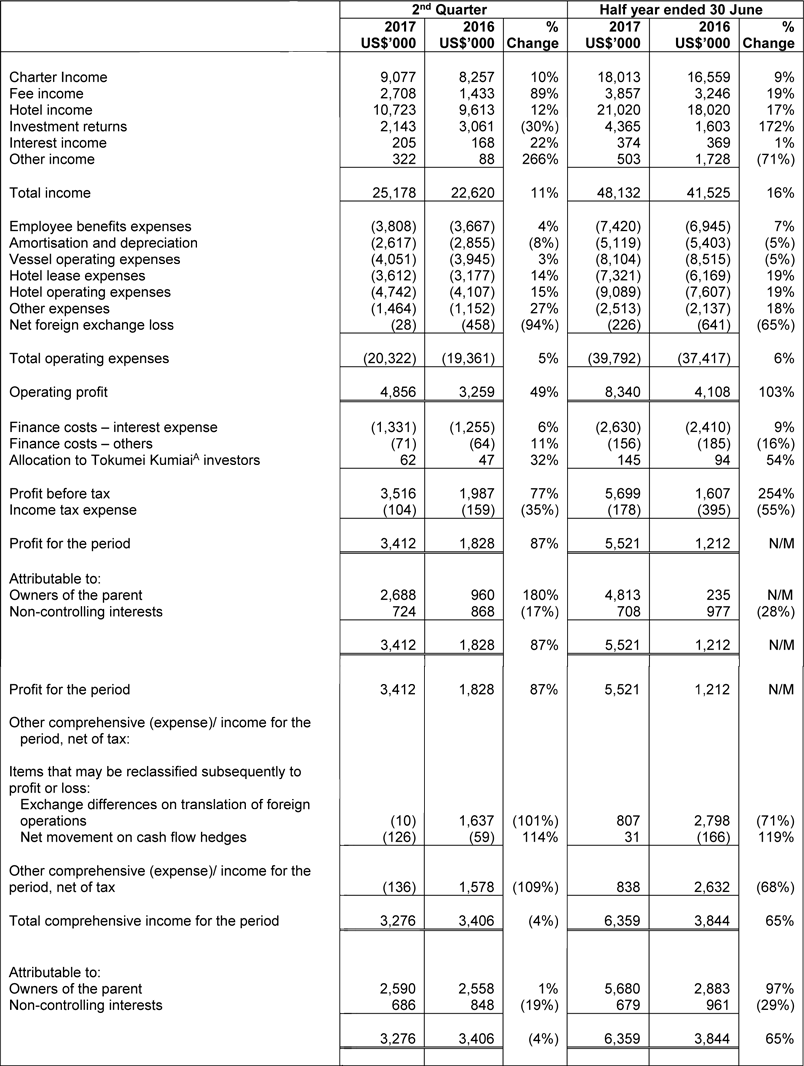

Income Statement

* Tokumei Kumiai ("TK") refers to a form of silent partnership structure used in Japan. Allocation to TK investors refers to share of profit and loss attributable to other TK investors of the TK structure.

N/M: Not meaningful

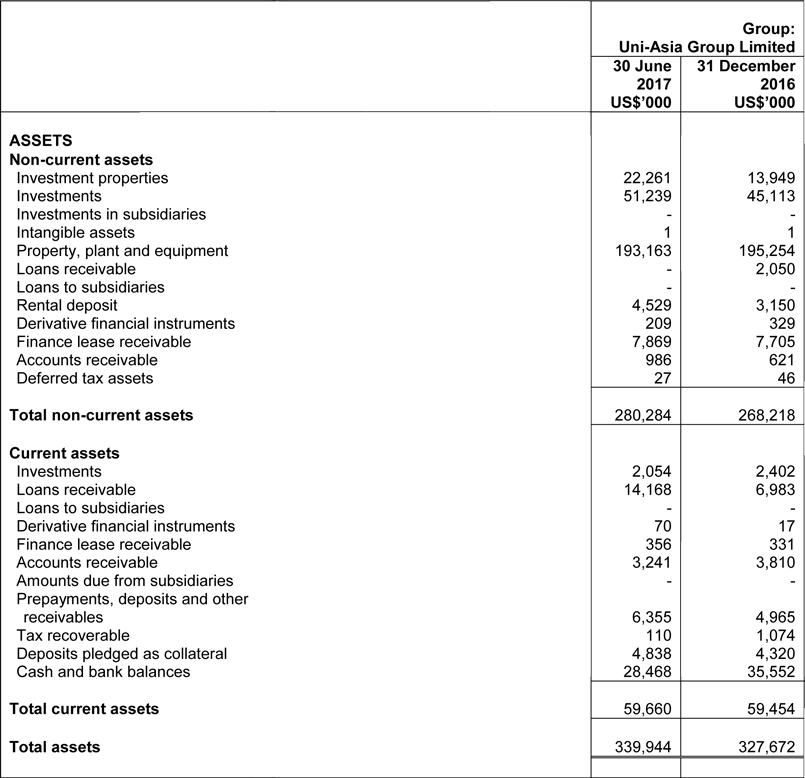

Balance Sheet

Review of Performance

Review of Income Statement

Total Income

Total income of the Group was $48.1 million for 1H2017, a 16% increase from 1H2016. Changes in major components of total income, including charter income, fee income, hotel income and investment returns are explained below.

(i) Charter Income

Charter income increased by 9% from $16.6 million in 1H2016 to $18.0 million in 1H2017. Besides better spot charter rates for the Group's portfolio of ships under short term charter, one main factor is the inclusion of charter income of the vessel under Joule Asset Management (Pte.) Limited ("Joule") in 1H2017, but only from 2Q2016 for 1H2016. This is because Joule became a subsidiary of the Group on 31 March 2016 and its charter income was consolidated from 2Q2016 for 1H2016.

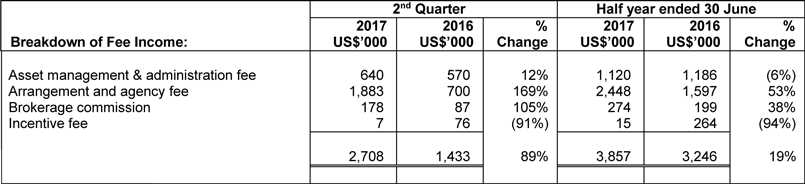

(ii) Fee Income

Total fee income increased by 19% to $3.9 million in 1H2017 from $3.2 million in 1H2016 due to more deals in 1H2017 for the Group's fee income business.

(iii) Hotel Income

The Group started operating its tenth hotel from 2Q2016, and accordingly, hotel income for 1H2017 reflected that of 10 hotels under operations, while the hotel income for 1H2016 was that of 9 hotels for 1Q2016 and 10 hotels for 2Q2016. Average occupancy rates of the hotels were slightly higher in 1H2017 compared to 1H2016 while average daily rates remained strong. Hotel Income increased by 17% from $18.0 million in 1H2016 to $21.0 million in 1H2017.

(iv) Investment Returns

Investment returns for 1H2017 was $4.4 million compared to $1.6 million in 1H2016. Fair value gain of $2.1 million was made for the Group's second Hong Kong commercial office property investment in 2Q2017.

Total Operating Expenses

While the Group's total income increase by 16%, the Group's total operating expenses increased by a lower rate of 6% from $37.4 million in 1H2016 to $39.8 million in 1H2017. Employee benefits expenses, hotel lease expenses and hotel operating expenses increased in correspond with the increase in hotel income.

Impairment and onerous contract provisions made by the Group in FY2016 resulted in lower depreciation on the Group's assets, as well as lower vessel operating expenses for 1H2017.

Operating Profit

Operating profit of the Group was $8.3 million for 1H2017, an increase of 103% compared to 1H2016.

Net Profit After Tax

The Group posted a net profit after tax of $5.5 million for 1H2017, as compared to $1.2 million for 1H2016.

Commentary

In 2017, the Baltic Dry Index reached a high of 1,333 towards end of March before retreating to 901 as at end of June. Notwithstanding this, the Group is cautiously optimistic that the commodities market would gradually recover leading to an improved dry bulk market. On the other hand, the property and hotel markets in which the Group operates remain robust. The Group's second Hong Kong commercial office property investment's construction is on schedule, and pre-sale of the office units was encouraging. The Group expects to exit this investment in early 2018, and would receive proceeds from this investment.