投资者关系主页

财务报告

Full Year Financial Statement And Dividend Announcement 2024

存档![]() 注: 文件是Adobe(PDF)格式。

注: 文件是Adobe(PDF)格式。

请下载免费的 Adobe Acrobat Reader 来查看这些文件。

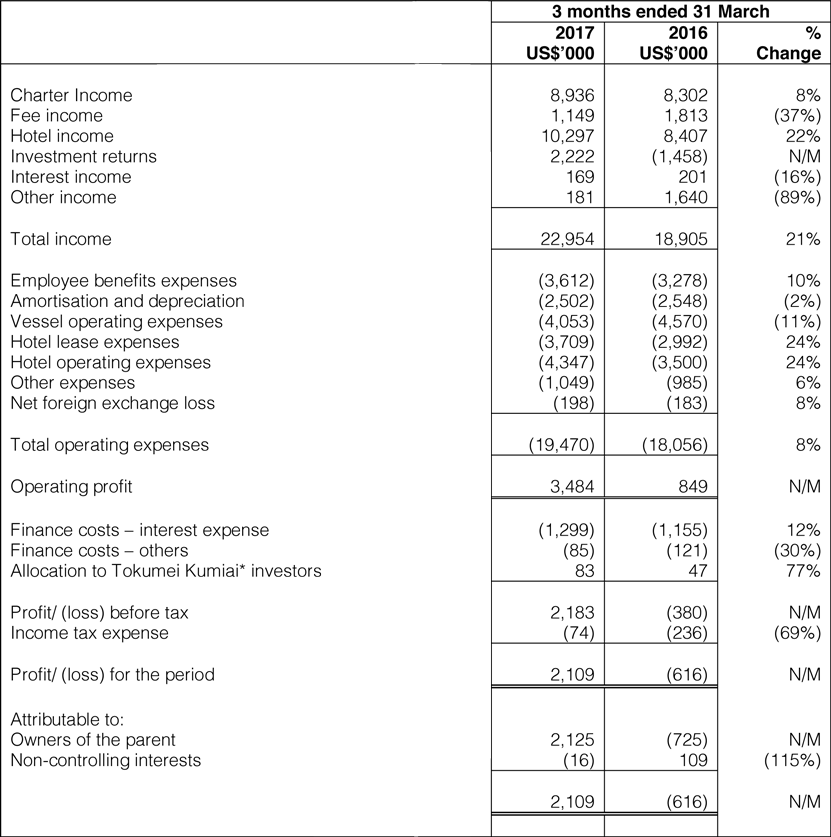

FINANCIAL STATEMENTS FOR THE QUARTER ENDED 31 MARCH 2017

Income Statement

* Tokumei Kumiai ("TK") refers to a form of silent partnership structure used in Japan. Allocation to TK investors refers to

share of profit and loss attributable to other TK investors of the TK structure.

N/M: Not meaningful

Balance Sheet

Review of Performance

Review of Income Statement

Total Income

Total income of the Group was $23.0 million for 1Q2017, a 21% increase from 1Q2016. Changes in major components of total income, including charter income, fee income, hotel income and investment returns are explained below.

(i) Charter Income

Charter income increased by 8% from $8.3 million in 1Q2016 to $8.9 million in 1Q2017. The main factor is the inclusion of charter income of the vessel under Joule Asset Management (Pte.) Limited ("Joule") in 1Q2017. Joule became a subsidiary of the Group on 31 March 2016 and its charter income was consolidated for 1Q2017 but not 1Q2016.

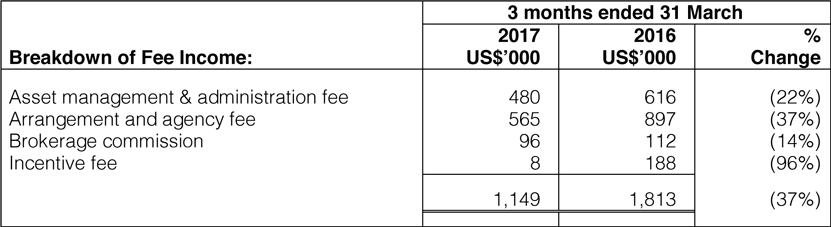

(ii) Fee Income

Total fee income decreased by 37% to $1.1 million in 1Q2017 from $1.8 million in 1Q2016 due to fewer deals in 1Q2017 for the Group’s fee income business.

(iii) Hotel Income

In 1Q2017, the Group has 10 hotels under operations as compared to 9 in 1Q2016. Average daily rates of the hotels was higher in 1Q2017 compared to 1Q2016 while occupancy rates remained strong. Hotel Income increased by 22% from $8.4 million in 1Q2016 to $10.3 million in 1Q2017.

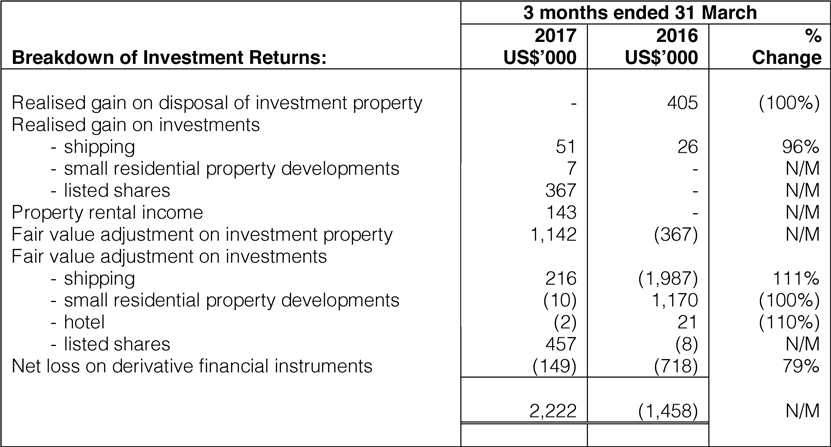

(iv) Investment Returns

Investment returns for 1Q2017 was $2.2 million compared to a loss of $1.5 million in 1Q2016. Fair value adjustment of $1.1 million was made for an investment property in 1Q2017. Following the fair valuation losses made for ship investments in FY2016, no further significant fair valuation adjustments were necessary for 1Q2017.

Total Operating Expenses

Total operating expenses for the Group increased 8% from $18.1 million in 1Q2016 to $19.5 million in 1Q2017. Employee Benefit Expenses, Hotel Lease Expenses and Hotel Operating Expenses increased in correspond with the increase in Hotel Income.

As mentioned above, Joule became a subsidiary of the Group on 31 March 2016 and its vessel depreciation expense was included in 1Q2017 but not in 1Q2016. However, such depreciation did not increase overall depreciation expense of the Group in 1Q2017 as compared to 1Q2016 as the impairment made by the Group in FY2016 had led to lower depreciation on the Group’s assets, which was sufficient to offset such increase. Amortisation and Depreciation Expenses for 1Q2017 is similar to that of 1Q2016.

Operating Profit

Operating profit of the Group was $3.5 million for 1Q2017.

Net Profit After Tax

The Group posted a net profit after tax of $2.1 million for 1Q2017, a reversal of a net loss of $0.6 million for 1Q2016.

Commentary

The Baltic Dry Index was 961 as at end of 2016 and was 1297 as at end of March 2017, an indication that the dry bulk market is improving. The property and hotel markets which the Group operates remain robust. While there are still many macroeconomic uncertainties, general business environment which the Group operates in seems better than that in 2016. With the improving business environment, the Group is better placed to achieve its business objectives for 2017.